🌐 REALTECH, 2023 in review

Highlights of key technology changes in energy, robotics, manufacturing, defence and tech geopolitics

Hi all, this is the last newsletter this year. 2023 has been full of exciting developments, and technology’s influence on the physical world is changing at a rapid pace - I hope you’ve enjoyed subscribing. 🙏🏼

What are some of the most interesting things that happened in the industrial transition in 2023?

As I reflect on the year, I have put together a few of the most interesting developments from a rapidly evolving physical world. This is by no means complete and no doubt I’ve omitted some important items.

I will be spending time over the holidays to write more in-depth reports on what happened in 2023 in energy, robotics, manufacturing, defence and tech geopolitics. If there’s anything you’d like to see, please let me know by responding to this email

Energy and Climate - everything everywhere all at once

Solar everywhere - Installation of renewables has accelerated at a pace most analysts were unable to predict (>360GW of solar power was installed globally this year). The bottleneck is no longer capital and appears to be grid access, permits and labour for installation.

China dominates supply chains - We have seen China’s dominance across a number of the technologies and resources needed for the industrial transition. China accounts for more than 80% of global solar cell exports, more than 50% of lithium-ion batteries, more than 20% of electric vehicles and 60% of rare earths and critical minerals. China’s dominance is driven by consistent government support, strong and low-cost domestic supply chains, and a massive home market driving economies of scale.

The EU just passed a resolution to enable more domestic resupply of critical minerals. This presents a quandary for European governments keen to use Chinese minerals and technology to transition to net-zero but also to cut their dependence on China. Some newer startups, like Magrathea are using technology to replace mining.

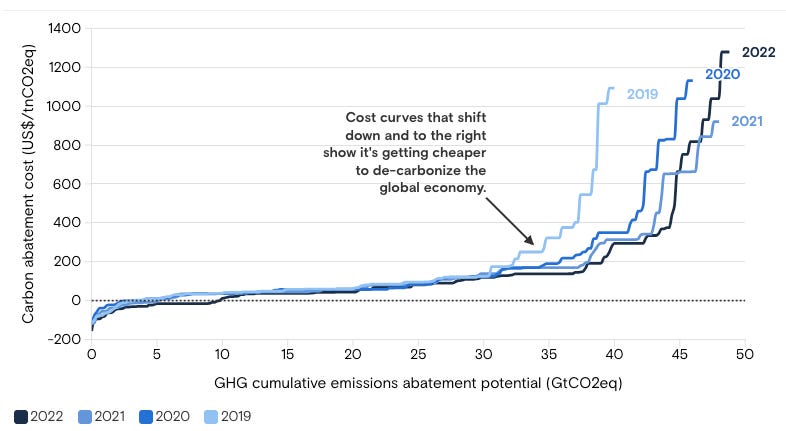

Net zero is getting cheaper - As more capital and talent move into the collective fight against climate disaster, cost curves are declining. Incremental capital mobilised for decarbonisation is now more cost-effective and continues to lower the cost to decarbonise, as per this Goldman research;

Nuclear has started to make a resurgence, as nations focus on resource nationalism and face steepening timelines to decarbonise their grids. This last week at COP28, 22 nations pledged to triple Nuclear capacity by 2050. According to Pew Research, 57% of Americans favour Nuclear, up from 43% in 2016.

Common refrains about Nuclear are high costs due to lack of standardisation, high regulatory hurdles and 6-8 year build times. One emergent area is (very) Small Modular Reactors (SMRs), which are factory-fabricated, transportable and rapidly reduce installation time.

There are some interesting emerging companies such as Radiant Industries, who are building container-sized reactors (pictured below), Avalanche Energy who are miniaturising Fusion, and Finland’s Steady Energy, who use small Nuclear for district heat.

Scientific and engineering breakthroughs. There have been several new and important breakthroughs in the fight against climate disaster. Fervo Energy’s successful test of next-gen geothermal (NGS) producing abundant heat from the earth’s crust, promising progress in limitless energy with consecutive breakthroughs in fusion, we improved our prediction of complex and chaotic weather systems using AI, numerous new and improved batteries including Nio’s new solid-state battery, and Northvolt’s new sodium-ion battery.

Robotics - from task-specific to general?

Recent developments in large language models (LLMs) have enabled rapid progress in robotics and embodied AI. LLMs provide sophisticated environmental perception and robust language and image processing capabilities which have been leveraged to advance embodied systems. For example, LLMs have achieved remarkable successes on few-shot planning and navigation tasks that demand accurate decision-making.

This has driven a shift away from traditional robotic learning and towards combining classical robotics with language and vision models. To unlock higher levels of intelligence, LLMs need embodiment through exploratory experience in the physical world. Numerous new datasets for embodied AI have been released, like PhysObjects, Open-X Embodiment and Ego4D.

We have seen interesting work in this area, such as DeepMind’s RT-2 and RoboCat multi-modal models, Octo and Nvidia’s Agent Driver. There have also been breakthroughs recently, such as an AI-trained, autonomous drone that beat the world's best human drone racers.

Autonomous vehicle startup Wayve, is an emerging leader in this field. This year they released AV2.0 - large, unified deep learning models that can control multiple parts of the vehicle stack, from perception and planning to control. In June, they released GAIA-1, a generative world model, which generates synthetic world scenes to train autonomous vehicles:

The potential for generalised learning is renewing interest in form factors such as humanoid robots, capable of general tasks and built to navigate a world built for humans. Multiple companies are vying for leadership including Agility Robotics, Apptronik and newer players like Tesla’s Optimus and Figures. Agility announced the world’s first robofab and has partnered with Amazon to test their Digit robot within a warehouse;

Defence - from ‘analog’ to ‘digital’

The Ukraine sandbox. The war in Ukraine has demonstrated that some commercial technology is more effective on the battlefield than specialised military technology. Ukraine has served as an unwelcome testing sandbox for new military technologies, a testament to the ingenuity and technical capabilities of the Ukrainian people.

We have seen rapid adoption of new commercial technologies, from open-source intelligence (OSINT), Starlink connectivity, 3D printed parts and armaments and heavily modified drones. Some of this new technology has come from smaller, private companies such as Quantum Systems and Velos.

The AI domain - The development of defence technology is accelerating as militaries recognise the need to modernise procurement, expand capacity, and move from ‘analog’ to ‘digital’. Defence forces are moving from siloed domains (land, sea, air, space, cyber) and largely mechanical vehicles to multi-domain systems driven by AI, software and unmanned robots.

The US Department of Defence (DoD) has recognised the importance of this shift, launching the Replicator program. Replicator has a relatively simple mission: to “field attritable autonomous systems at scale of multiple thousands, in multiple domains, within the next 18-to-24 months.” The DoD specifically created the Defense Innovation Unit (DIU) to help the Pentagon leverage private-sector tech and hired an ex-Apple VP to run it. The DIU has enjoyed a surge of new interest and funding after Ukraine demonstrated the utility of commercial hardware.

Consensus - This shift has triggered a closer relationship between defence departments and private sector tech. This year, defence investing went from taboo and “non-consensus” to “consensus” amongst venture capitalists. This was buoyed by increased government spending and large funding rounds such as Anduril’s $1.4bn Series E, Skydio’s $230m Series E and Shield AI’s $200m Series E. Venture-backed startups are increasingly looking to step into the gap left by defence primes, who are struggling to provide the leading-edge technology needed for modern warfare.

Manufacturing - reshored and reinvigorated

Boom - The big story is the US’s manufacturing boom, funded by the Inflation Reduction Act (IRA) and Chips Act. These acts are subsidy packages designed to stimulate investment in critical industries such as manufacturing and semiconductors, cutting reliance on China. The acts have worked fast (chart below). This has pulled-in lots of new talent and ideas, and sped up the digitisation of existing industrial lines.

An emerging Silicon Valley for hardware - Los Angeles - El Segundo to be precise - has emerged as a new hub for aerospace and advanced manufacturing, enabled by the depth of talent in local companies like Tesla, SpaceX, Relativity Space and legacy aerospace companies like Northrup Grumman and Boeing. Musk biographer, Ashlee Vance, has a good feature on this new scene:

Convergence of IT/OT - The digitisation of industrials (“Industry 4.0”) has long been talked about but this year saw a rapid acceleration of this trend. Industrial sites are increasingly adopting software best practices. Industrial data pipelines and hardware-decoupled control systems have seen tighter integration between IT and OT (operational technology), unifying data management and control. Modernised robot programming software like Google’s Intrinsic, ROS2 and low-code platforms addressed persistent skill gaps and labour shortages by enabling easier automation.

Let’s get Digital (Twins) - This new need for data and analytics is powering new digital twin use cases, allowing physical operators to replicate, monitor and test their environments in silico. Meanwhile, digital twins, modular architectures, and quick reconfiguration capabilities increased manufacturers' agility in responding to changing shifts in supply and demand. Hyperscalers (cloud providers) and software companies are increasingly moving into embedded software/hardware and industrial platforms:

Gigacasting - Once again, Tesla changed the car game, this time by innovating on the vehicle production process. Tesla has implemented ‘Gigacasts’ from the Italian IDRA Group. These die-cast presses weigh between 6,000 and 9,000 tons and can produce very large, single metal parts using huge compressive forces. Tesla uses these large parts for, say, the underbody of the Model Y. Traditional automakers would need 400 components for the same part. This dramatically reduces the need for robots, welds and sequential processes in its manufacturing line. Following Tesla, other carmakers such as Toyota have moved rapidly to adopt this technology.