Software is eating the real world

RealTech - why the biggest companies of the next cycle will improve the physical world and how VCs will have to get comfortable with CAPEX

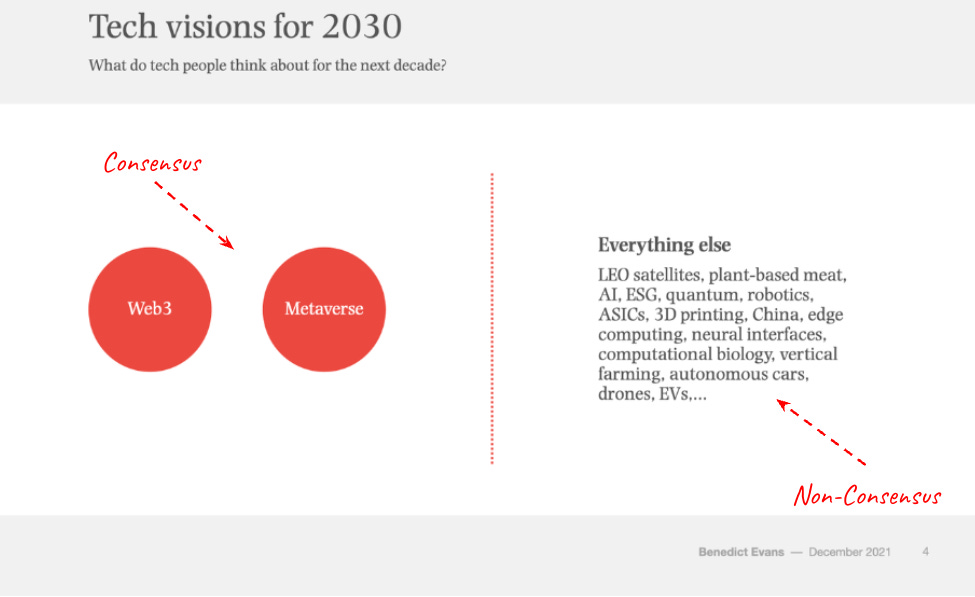

Driven by the material challenges of climate change, trade geopolitics and ageing populations, software innovation is meeting hard engineering. This shift towards "RealTech” is also a bid by new (software) companies to go after harder value chains with larger, established markets. For VCs to capitalise on this development, they must challenge their entrenched bias against hardware and conceptualise a new type of company and playbook.

Fairchild Semiconductor built the modern Silicon Valley - in terms of technology, talent and as the antecedent to businesses such as Intel, Apple, Genentech and Cisco. These hardware businesses are some of the most important foundational businesses that most existing technologies stand on top of. Hardware has been less in vogue, with founders concentrated on expanding the realm of the virtual, though history rhymes. Software continues to eat the world, but a confluence of factors is accelerating the trend of companies being built at the intersection of software and the physical world.

We're at the precipice of multiple paradigm shifts, many of which will manifest themselves in the physical world. We are about to re-engineer creaking infrastructure, fragile supply chains, destructive energy production, combustion-based transportation, defence systems , materials and biology. This is being driven by a number of converging themes - internet-enabled businesses moving from weaker value chains to progressively larger ones, the climate crisis, technology and trade geopolitics, an imminent demographic crisis in the West and the toolchain for physical products being rebuilt in software.

Many of the largest technology companies to date have created new markets within the world of bits, expanding and monetising the virtual realm. Though, we’ve seen a number of outlier companies within RealTech already, such as Nest, Tesla, Flexport and Uber. Founders and VCs will need a set of new mental models and playbooks for creating companies in this new, physical world.

“Venture dollars have mainly been concentrated on expanding the virtual world - the next cycle will be about improving the real world”

Old theme, new solutions

Let’s take a look at the emerging themes, driving this secular RealTech trend;

Internet businesses will start attacking harder value chains as we see a slowdown of growth rates of software businesses within cloud and mobile platforms. This is driven by slowing internet penetration, nearing the upper limit on daily smartphone usage and increased competition through lower barriers to software creation. We need to see a new platform shift emerge if we want growth rates to sustain. Internet businesses have moved and evolved to where the ability to disintermediate is lowest. From information markets (messaging, social) where barriers to entry were low, to progressively harder value chains where markets are larger, proven and legacy incumbents are entrenched (transport, supply chains, materials).

The climate crisis has mobilised capital and talent to build solutions for the world’s most pressing issue. The reality of fighting climate change is that software will merely be an enabler to hard, real-world engineering which will remove gigatons of CO2 from the atmosphere. At this intersection, founders are creating products in energy, materials, agriculture, carbon removal and re-inventing existing behaviours

The global political powers are playing technology and trade geopolitics. The polarization of the US, EU, China and others has created cold wars in technology sovereignty and trade (especially energy). Countries are now starting to reshore manufacturing capacity and limit reliance on global supply chains and trade partners, trading cost efficiency for control. This is creating a surge of localised investments into R&D and manufacturing. US government R&D spending has dropped from the 1960s highs of 2% of GDP to less than 0.7% of GDP. In August 2022, US Congress announced the $400bn Inflation Reduction Act. The EU has earmarked nearly €100bn for R&D spending through Horizon Europe and the UK has launched its ARIA program and deregulated a number of industries. These programs are designed to fund R&D within areas such as climate, energy and cities

There is a demographic shift in the West. An ageing population and low birth rates are skewing the population towards those who are not of working age. Alongside increasing minimum wages, this is increasing the economic imperative to automate jobs, especially within the service industry where wages are lower. There is a causal link between countries with ageing industrial work forces, such as Germany and Japan, and investment into robotics. We expect this trend to be more prevalent across the West

A new software and hardware tool chain is being built, by qualified talent that have lived these problems at existing RealTech companies. These abstractions are making company creation and product building increasingly easier, faster and cheaper. Starting at the most fundamental layer, the evolution of GPUs is creating a number of new innovations at nearly every layer of the stack above that. We’re seeing innovations in cloud such as Benchling, design such as Shapr3D and KittyCADwhich who are re-imagining CAD design, in-silico simulation with enhanced physics engines such as Nvidia’s Omniverse, Unity or SimScale , protocols such as Violet Labs and Robotic automation and control such as Opentrons or Automata

There are a number of companies who are well placed to take advantage of these changes. Though, my belief is we’re in the very early innings of the RealTech super-cycle.

Alongside these macro inflection points, there are a few things the Industry needs to work on. For VCs to let go of their inherent bias towards software pure plays and to demystify the building and scaling of physical business, the industry needs to increase the qualified talent starting businesses as well as continued regulatory support.

Challenging the status quo

When VCs look at companies which are either hardware or have a CAPEX-intensive physical component, they visibly recoil. The prevailing narrative is that “hardware is hard” - hard to scale, comparatively expensive to distribute (versus zero marginal cost software), prone to positive cash conversion cycles and expensive to fund first products, in many cases that's true. Though, that misses the bigger picture.

Contrary to this narrative is a reminder that 35% of Apple, Amazon, Google and Microsoft's revenue comes from hardware or related services (such as cloud servers and logistics). As a percentage of their net margins, this figure is even higher. Companies such as Amazon have achieved mind-blowing scale and defensibility through selling physical server capacity and building their own logistic network. Apple has a vertically integrated supply chain and has a monopoly in high-end electronics and associated applications. Additionally, history has proven that the adoption of physical products is no slower than internet-connected software products;

What tends to get missed is that products in the real world, often have unbounded market sizes, lower risks regarding early product-market fit given markets (often existing and demand is proven). Competition is often mainly from slower moving legacy incumbents.

A new mental model for a new type of company

We’re seeing the emergence of a few different types of companies in RealTech. It’s worth mentioning that there’s a clear delineation between companies building proprietary hardware in combination with software, and companies merely leveraging software with commodity physical components. Let’s compare and contrast software with RealTech;

The Future

There is a small but burgeoning scene of RealTech founders, many of whom come from multi-disciplinary backgrounds across the gamut of engineering sciences and business.

Beyond new playbooks and mental models - for the space to take off we still need more talent having operated in relevant high-growth companies. Additionally, there are still too few ‘role models’ within this world, with Tesla, SpaceX and Nest likely the best known. These companies are antecedents to Northvolt, Proterra, Form Energy, Relativity Space etc. However, it's clear that role models, identification of talent and on-ramps to company creation are still yet to create a flywheel effect. There is a generational opportunity in finding talent networks, demystifying company building and providing capital and support for RealTech founders.

great piece Sam! I wrote something in a similar vein in July:

https://blog.joinodin.com/p/new-adventures-new-heroes