Hey, hey - you haven’t heard from me for a while as I’ve been busy cooking up a few things.

Namely, a new weekly newsletter on how technology is reshaping our physical industries. Thought I’d share a short excerpt from the newsletter below. Subscribe if you vibe with it!

p.s 🇺🇸 Happy 4th to all the US readers! 🇺🇸

Tesla charging network; why Tesla won, Standards and taking a tax on North American EVs

Charging networks, really? Bear with me. This is more interesting than it seems. This is a great case study in turning vertical infrastructure spend into a moat.

To date, there has been a battle for the electric vehicle charging standard, the North American Charging Standard (“NACS”) versus the Combined Charging System (“CCS1”). These are the cables that charge vehicles, for both AC and DC charging.

Being early

Tesla was early in building this infrastructure - this vertically integrated approach was critical to the sale of their vehicles. Consumers would not buy a mid-range EV if they didn’t have clear charging coverage.

Tesla has deployed 12,000 charge points across the US since 2012, incurring huge (Capex) costs. They own the whole experience and have had longer to iterate on the charging product than the competition. Their chargers are faster, more widespread than the competition and generally accepted as superior.

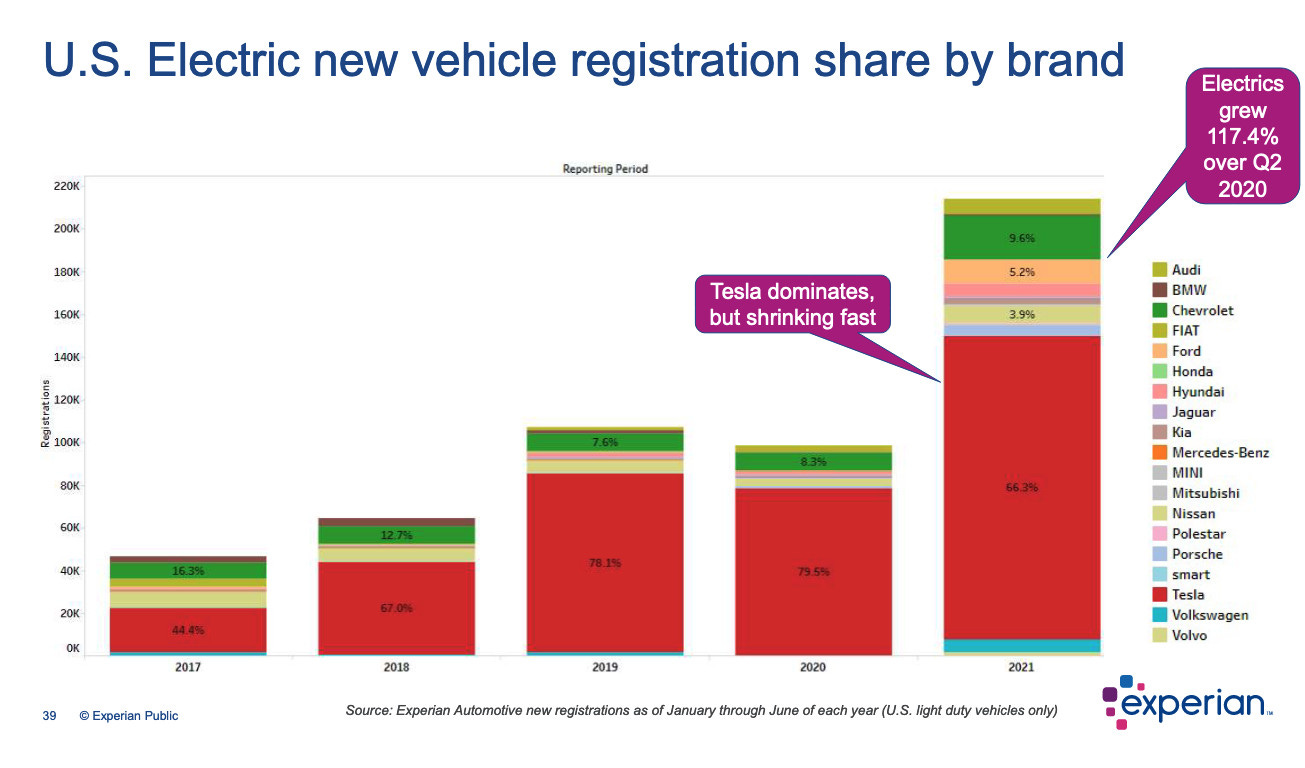

Tesla also benefitted from being able to ‘tip’ the network in their favour - they’ve consistently had the most EVs on the road. This means they have considerably lower per-unit costs to deploy the charging network versus the competition:

Turning costs line items into revenue

Recently, automakers, GM, Ford, Rivian and Volvo, announced their EVs would be using Tesla’s electric chargers in North America. The fundamental business equation for the competition is a simple buy v build;

is it cheaper for me and my customers to pay Tesla a fee or to build my own network?

By some estimates, this would have cost GM $400m in Capex over multiple years, to arguably get to a similar place.

I have previously written about, abstractions in physical industries:

“A good example of the full stack approach is Tesla, who decided to vertically integrate, cut reliance on suppliers and put software at the core of the product. […]. It also means they can use their scale to sell an abstraction to competitors. Could Tesla sell their battery management software or full service driving (FSD) to other companies? Potentially.“

Tesla has illustrated this strategic advantage of vertical integration.

Whilst, this is a short-term hit to Tesla’s differentiation. It gives them a very profitable, high gross margin business, with most of that revenue falling to the bottom line. They are now collecting an effective tax on most EVs in North America. They have turned a cost disadvantage into a revenue line and moat.

Tech Tax

In many ways, this is a familiar story of technology standards being pushed by rival tech firms. Think VHS v Betamax, or HD DVD v Blu-Ray - Some of the best technology businesses have been created in a similar way:

ARM Holdings: they licence the architecture for all iPhone chips

$2.7 billion revenue (FY22), w/ 95% gross margins

Qualcomm: all US based cell networks use their CDMA standard (Europe has GSM)

$24 billion revenue (FY22), w/ >70% gross margins

Amazon AWS: turned their server infrastructure into their main profit driver

$80 billion revenue (FY22), 60% gross margins, 25% operating margins

If you’re ever building a heavy Capex component for a new business, that has general applicability to other competitors, network effects and superior product features. Keep an eye on opportunities for future monetisation.