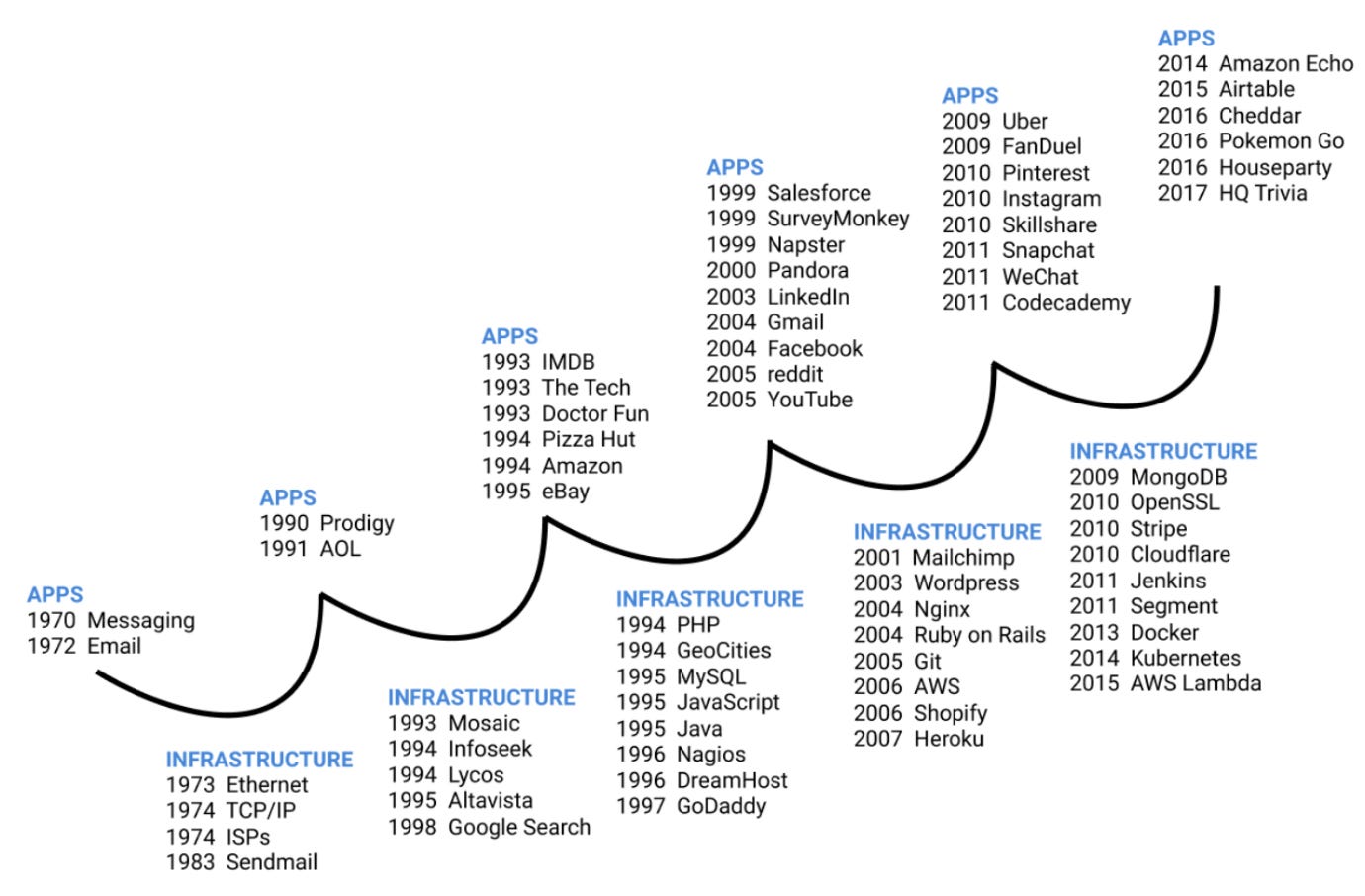

The ensuing explosion of abstractions and applications in emergent industries

The key question for investors in emergent industries is whether infrastructure or applications will produce better returns on invested capital

In my last piece, I posited that the venture industry would turn to investments with heavier CAPEX components in foundational industries. Following this, a number of people sent me an interview with economist Richard Napier, in which he discusses the return of secular infrastructure and CAPEX spending from an economic viewpoint. It’s a great read. I, however, would like to look at this phenomenon from a bottom-up, technological viewpoint. I believe that increased research and development (R&D) and infrastructure spend will also lead to the emergence of companies at the application layer. The relationship is symbiotic:

More infrastructure -> more applications -> more infrastructure abstractions

Firstly, regardless of what most software investors believe, most software companies have large CAPEX (capital expenditure) components. For these companies, CAPEX investment means investment in software R&D. CAPEX is capital which is used to grow or maintain a company's asset base. In software companies, this asset base is the software itself. It is usually built and maintained by developers, whose main cost is salary. Typically, these costs are pulled through companies profit and loss (P&L) statement and treated as spending on research and development (R&D) which are intangible assets and are operating expenses (OPEX). The lifecycle of software typically means high maintenance costs including debugging, extensibility and UI/UX improvements. These costs are maintenance CAPEX but they are treated as R&D. This is important as these accounting principles change the financial profile of businesses, R&D is on the income statement and CAPEX is on the balance sheet. Importantly, VCs have had an aversion to CAPEX-laden balance sheets.

I would bet that the majority of software spend in the last five years, especially for later-stage companies, has been maintenance CAPEX and SG&A (selling, general, and administrative expenses – essentially, the cost to sell your product). SG&A is likely to be the greater part of this spend - because the importance of distribution has outranked the importance of product build, especially when building at the top of the stack. I wrote about this here.

💡 “We will see a boom in capital investment and a reindustrialisation of Western economies” - Russell Napier

Some of this might be explained by the increasing number of software abstractions created, there is vertical SaaS for nearly every discrete function of your business. These abstractions can get you to market faster and cheaper but can also pull value out of your company. Need an e-signature solution, use Docusign, need a landing page, use Wix, need a webstore, use Shopify. With transfers of operating complexity come partial transfers of value away from your business and the lowering of costs (more OPEX, and lower CAPEX / R&D).

These abstractions could be thought of as infrastructure; often they are the rails on which your business runs. The most impactful abstraction in recent history was the launch of Amazon Web Services (AWS). Software companies no longer have to rack physical servers. Amazon has abstracted the complexity of running servers and charge on a marginal pay-per-play basis. This increase in infrastructure / abstractions forces a lot of companies to build applications at the top of the stack, where you don’t have to worry about all that middle and bottom stack complexity.

Within emergent industries such as Advanced Manufacturing, Energy or Defense, initially there is often little choice but to go full-stack. This means building full-stack startups, where most of the business components and cost line items have to be built from the ground up, as no abstractions have been built yet. The lack of abstractions in these industries is both a challenge and a means of building value and defensibility if successfully conquered. A good example of the full stack approach is Tesla, who decided to vertically integrate, cut reliance on suppliers and put software at the core of the product. This provides them with an ability to innovate and ship new products and updates faster. It also means they can use their scale to sell an abstraction to competitors. Could Tesla sell their battery management software or full service driving (FSD) to other companies? Potentially.

Other emergent examples of going full stack are synthetic biology companies. Typically these companies need to run their software platforms, their own labs and, ultimately, their own bioreactors (at great expense). Or think of an advanced drone manufacturer who needs to cut its own custom CNC metal parts. If you want to create an abstraction in an emergent field, it is best to look at an application companies’ P&L and start building within the most costly line items.

This means that there is both infrastructure and applications to be built in emergent spaces. It’s a misnomer to believe that infrastructure comes before applications. As USV’s Nick Grossmann rightly points out, applications often come first: Planes were invented before airports, lightbulbs before the grid. The application<>infrastructure phase is reflexive. Each side works in unison to expand the market opportunities for the other.

“The history of new technologies shows that apps beget infrastructure, not the other way around.” Nick Grossmann

Undoubtedly we will see more infrastructure, CAPEX and R&D spend within a number of markets but, simultaneously, we will also see an explosion in the number of applications. In turn, this will fuel the demand for more abstractions. So, whilst Richard Napier argues that infrastructure spend is coming back, the bigger story is which applications this spending will precipitate? And for investors, will applications be more valuable than the underlying infrastructure it runs on?

Were I to bet on any break in the standard pattern of progress in internet technology in the next market cycle it would be this: RealTech companies - those companies which bridge software and the real world - will vertically integrate and own various layers of their stack. They will do this as a) initially they have no choice b) through time, to exert more control over this bridge. Whilst building full-stack startups is hard from the outset, it provides companies with increased control, the ability to innovate faster and long-term defensibility.