The tech world currently feels like a frenzy, with an acceleration of growth rates, tech trends and company creation. I present a framework for how I think about breakout technologies and which are likely to catalyse a platform shift, we'll explore:

The importance of technology platform shifts versus macro environment

How prior platform shifts started, and which patterns they emerged under

A framework for spotting new breakout technologies

Applying said framework to Crypto, Climate, SynBio and AR/VR and whether we’re at the precipice of a new platform shift?

Many are talking about the macro environment, persistent inflation, record asset prices and record debt-to-GDP, should give pause to most investors. Venture returns are highly correlated to both macro cycles and even more so waves of emergent new technologies. Over the last 40 years, we have seen a general acceleration of these technological waves (“🌊”) driven up to now by Moore’s Law. As we look past the long bull market we’re currently in, other than the macro, a bigger question should loom for technologists; where will the next breakout 🌊 come from?

I think about this question using a framework native to how I view technology, through the lens of the initial consumer, which should help highlight the early signs of interesting new breakout spaces.

As of today, we have not had a platform shift since mobile and the launch of Apple’s App Store in 2008. Many are even arguing that we are at the end of what Carlota Perez would call the ‘Deployment Phase’ and that some of the tailwinds that have been driving tech returns are dwindling. I would argue otherwise.

It’s clear that outsize company creation and returns happen when new technologies and platform shifts occur. Jerry Neumann beautifully makes the case for this in Heat Death: VC in the 80s, when venture returns in the 1980s evaporated.

“But the biggest problem, in hindsight, was that the sectors that had produced the best returns in the early ’80s were no longer delivering.”

Platform shifts and heated markets precede an overcapitalisation which destroys industry-wide returns, this is both an over-supply of capital and an under-supply of new breakout technologies.

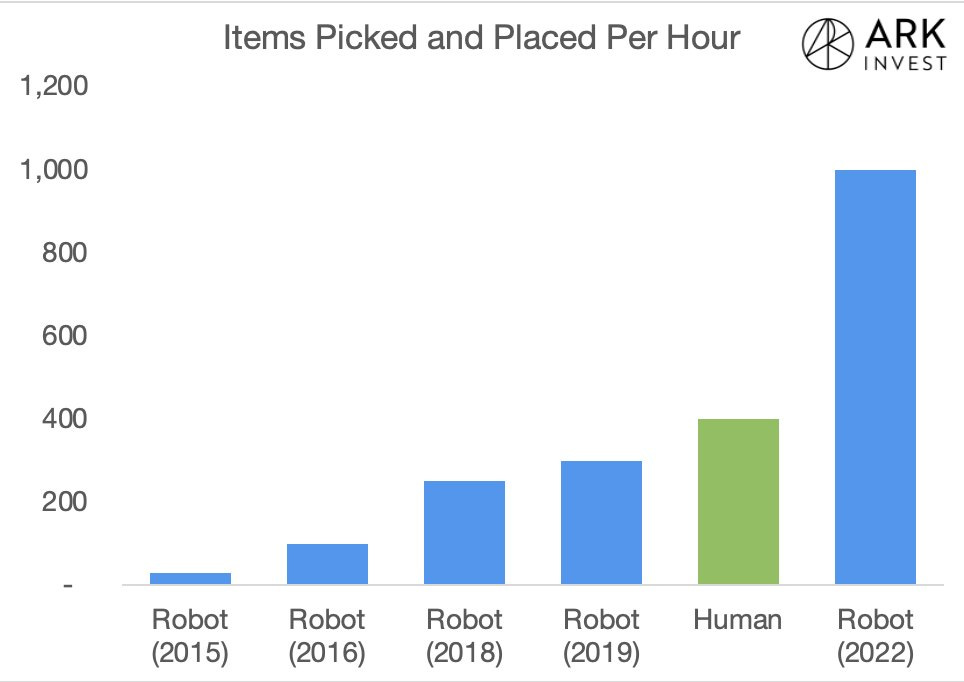

One thing is apparent, we can feel it, these waves are arriving faster and more frequently. This is evidenced by a number of factors. The average age of companies in the S&P500 has decreased from 60 years old in the 1950s, to less than 20 years old today, with companies being an order of magnitude larger. We have a confluence of accelerating new technology adoption, an overdue platform shift, a covid-induced TAM expansion and a host of new potential new waves. Today, we might have both a perceived over-supply of capital AND a number of new Nazaré-sized technology waves ready to hit the shore.

(source: Dealroom, Sifted, Slush)

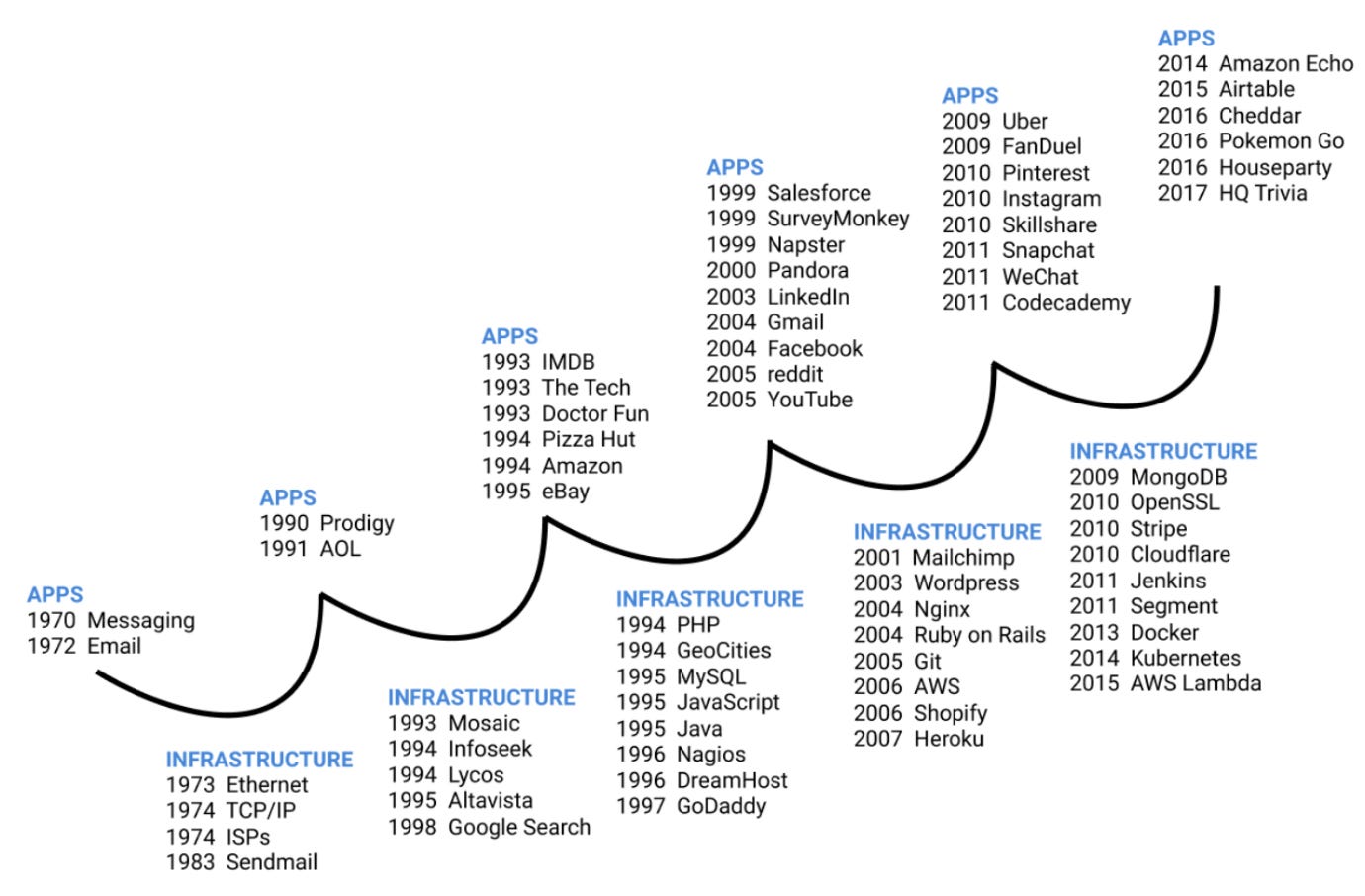

Looking at prior 🌊, from PCs, web, mobile, most of the early applications following a similar pattern of emergence:

Hackers and rebels: talent is drawn to seemingly fringe technologies and interest areas. These counter-cultural forces pull in tinkerers, hackers and rebels. This is what has made Silicon Valley such a force, a home for seemingly fringe activities. These fringe ‘scenes’ (see: Scenium) reflexively becomes an increasingly strong gravitational force for the best talent

Solving your own problem: Consumer applications are built earlier than B2B ones, as builders look to solve their own problems, additionally acquisition cycles are shorter and application feature requirements lower. Often, consumer UX often becomes the benchmark for business applications

New, emergent behaviours: These platform shifts also allow experiences and use cases that were simply not possible before. Think of the first time you used Uber, seeing the car travel towards you, the advent of GPS and the GUI on your smartphone made that experience possible. These new experiences catalyse powerful, new behaviours and become consumer defaults

PCs - The advent of the integrated circuit allowed the creation of home computing, fringe talent such as in the Homebrew Computing Club can be directly traced back to the roots of both Apple and Microsoft. The early applications that came out of this group were largely focused on building home computers for their own uses, largely word processing and games. Companies such as Dell, early on focused mainly on repackaging and assembling complex parts into usable devices for their end-users.

Web - The early development of Mosaic by Marc Andreesen, which ultimately led to the Netscape browser, took place within the lab of the University of Illinois. Marc partnered with Jim Clark of SGI, an entrepreneurial rebel, who’s exploits have been immortalised in a Michael Lewis book. Netscape is a good example of a company, which was created by rebels looking to solve their own problem, whilst abstracting the complexities of protocols such as TCP/IP/HTML.

Viewing emergent waves through this consumer-first lens, leads us to ask where new breakout consumer applications are happening today?

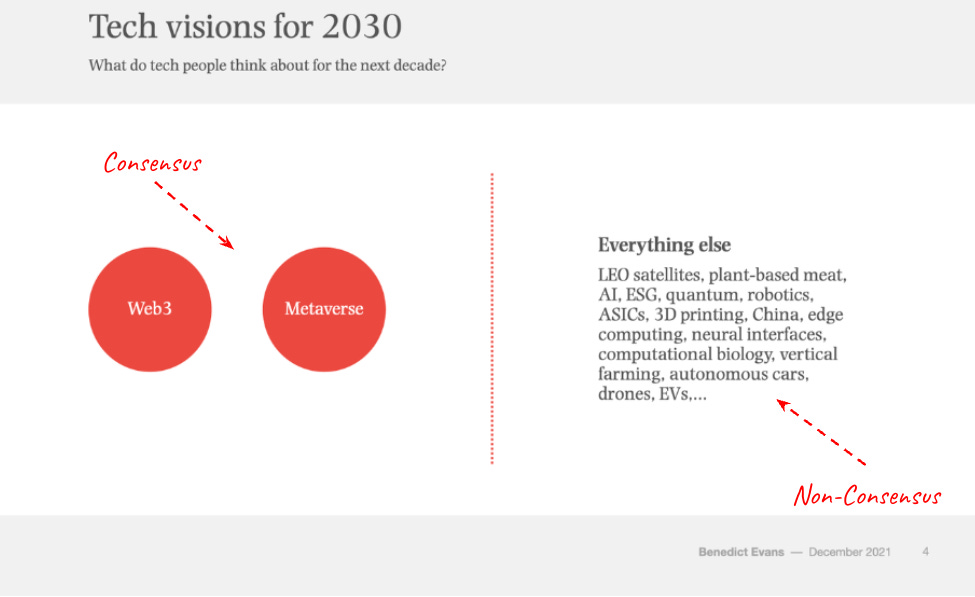

The new potential breakout scenes which technologists are most excited about are arguably Crypto, Climate, SynBio and VR/AR (“metaverse”). As we stand on the precipice of these new technologies, it feels like many or all of them could become breakout 🌊 of their own, which would be an unlikely break from the historical norm.

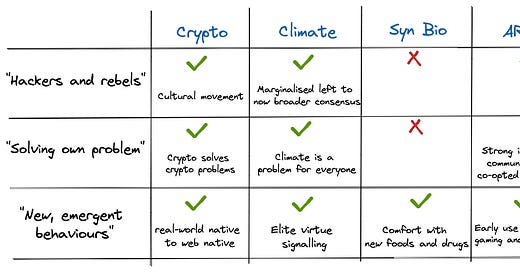

Whilst I appreciate, applying narrow maxims to these technologies is reductive, I do believe that most new new things tend to rhyme with historical comps. Applying the framework to these spaces, might give us a sense of what repeats and what doesn’t:

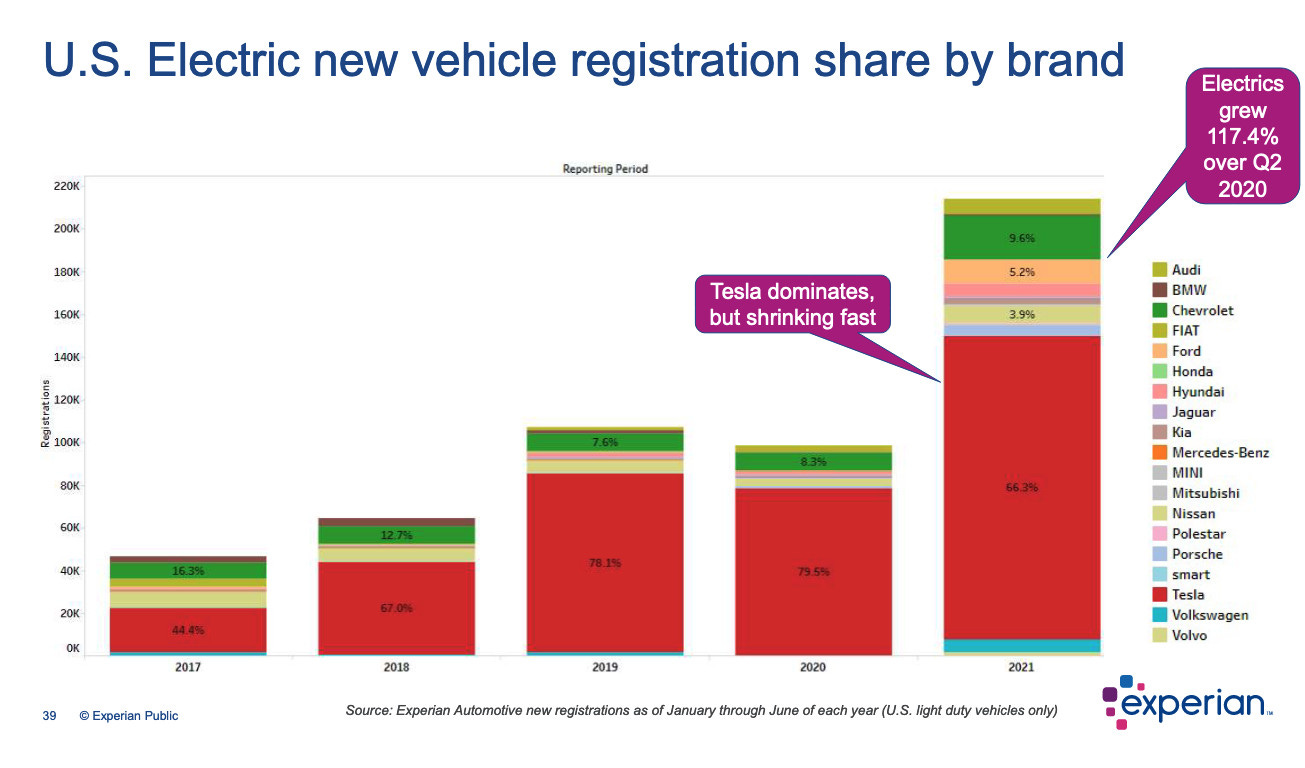

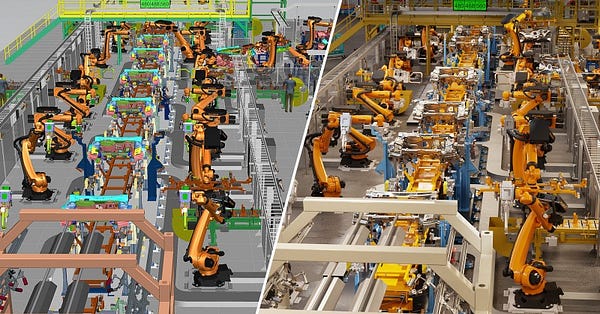

Until very recently, there had not been a broad consensus around the threat of climate, with early proponents marginalised as extreme. Today, much of the world has caught up to this view and environmental sensibilities have become a means of elite signalling around conspicuous consumption. Lighthouse companies such as Tesla, arguably created their initial product in order to solve their own issues, namely the lack of usable electric vehicles. However, as of today, there remains a significant information gap between the actions of individuals and firms, and the negative externalities caused upon the environment, the problem remains multivariate and complex which is part of the opportunity for technologists.

and web3 definitely continues to be a counter-cultural movement, in defiance of existing governmental structures, policy and legacy tech. The primary criticism of crypto today is that the technology hasn’t had its Netscape moment, it hasn’t crossed the chasm yet. Most of the current products are new and the coordination mechanic for web-native people is novel, though most use cases are self-referential and designed to solve problems that exist only in the confines of the crypto space. Companies like Coinbase, OpenSea and MetaMask have abstracted some of the complexity of protocols and assets away for non-crypto natives.

Given the high consequence nature of synthetic biology, most leaders in the field have institutional credentials either from academia or biotech companies. Most products start not necessarily to solve their own problems, but predominantly to tackle hard problems within their specialism. Whilst not strictly adhering to the definition of SynBio, the founder of Beyond Meat is a break from the norm. The company is an example of an early consumer use case that has catalysed a new behaviour whilst solving a problem for the founder, that vegans had no good fast food options.

Many existing platforms have co-opted visual computing such as Facebook’s pivot to the metaverse, Snap’s existing AR capabilities and Apple’s expected entry into the space. Oculus (acq. By Meta) is the best known company in the space and was founded by Palmer Luckey, a long time VR who was frustrated with the quality of headsets in the market. As of today, VR/AR has yet to cross the chasm out of some narrow gaming and communication use cases. Current platforms are certainly betting on both the potential of 3D computing experiences and the benefits of having integrated hardware + operating system + application software (h/t Zuck).

Whilst this might sound prescriptive, I’m aware of the limitations of frameworks. As we look past the next tech cycle any or all of these technologies might scale, within a timeframe I can’t predict. All I know is the future will be exciting!

Be well!

Sam